TSP Annuity Rates - How Low Will They Go?

June 6, 2012

Thrift Savings Plan administrators recently announced that the interest rate for annuities purchased in June will be 2.125%. This interest rate is unchanged since February, when it dropped from 2.150%. This is an astoundingly low interest rate for an annuity, and it is a result of incredibly low interest rates since 2008.

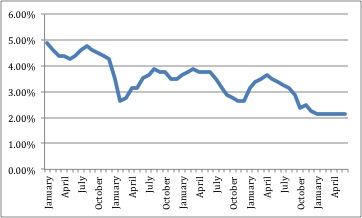

The above chart shows the slow decline of TSP annuity rates from January 2008 to June 2012.

These rates appear to be headed even lower in the coming months. With the continuing political turmoil in Europe and precarious debt burdens throughout the developed world, yield on the 10-year Treasury on June 1st fell below 1.5%, from 3% in early June last year. This is the lowest 10-year yield since World War II, as nervous investors buy U.S. bonds for added safety. Annuity rates tend to mimic the yield on government bonds, so annuity rates will probably trend down further. The question is, with such low rates, are annuities—even with their guaranteed return—still a good investment option or are there better alternatives for steady income over the coming decades?

Annuities are a type of insurance product that are purchased to provide monthly payments for the rest of your life – and depending on the annuity, the rest of your spouse’s life if you die before he or she does. So if I were turning 60 and bought a $500,000 annuity with no special features (and $500,000 is attainable for serious long-term TSP investors), I would receive a payment of $2,307 a month for the rest of my life, according to the TSP annuity calculator (which was replaced by the handy Retirement Income Calculator shortly after this article was originally posted - the calculator also hides the still-low interest rates for annuities, unfortunately). I could die next year or I could die at age 120, and it would not matter: I would still receive that same amount, every month. This is the “insurance” part of the annuity payout, insuring me of a guaranteed monthly income no matter how old I get. The payout is so low because the current interest rate is very low, although the relatively young age of the annuitant in this example is also a factor in lowering the payout.

While buying an annuity allows the investor to lock in monthly income for life, the risk is that significant inflation in the medium- and long-term will overcome the advantages of a stream of life-long income.

If I wanted a monthly annuity payment that rises each year with inflation, the initial monthly payment would be less – $1,499 – but it would rise according to the consumer price index. (Again, the payout is so low because the current interest rate for annuities is very low.) If inflation is less in a given year, it will rise less, but if inflation is higher, the increase is capped at 3% per year. In this case, the monthly payout would increase to $1,544 at age 61, $1,590 at age 62, and on and on, assuming it rises by 3% each year. By age 80 the payout would be approximately $2,707 a month, and at age 101 the payout would be over $5,000, at $5,036 a month. (This is no joke: just as there is inflation in any healthy and growing economy, there is “age inflation” in prosperous societies, so that we need to plan for longer lifespans in addition to rising prices as the years and decades go by.)

Other types of annuities offer payouts to surviving spouses in case of the TSP annuitant’s untimely death, which is an additional insurance product that will drop the monthly payout still a little more.

The payout is now so incredibly low that one wonders whether there are other higher yielding (non-annuity) alternatives. The dividend yield of the S&P 500 – the C Fund – for example is now 2.32%, and it appears to be trending higher as more companies initiate or increase their dividend payout. Amazingly, that 2.32% is now higher than the 2.125% interest rate on the TSP annuity. It is certainly higher than interest rates of savings accounts at banks. While the initial monthly dividend payout of $500,000 invested in an S&P 500 fund (just over $966/month) is still less than the inflation-indexed payout of $1,499, it has generally increased over time even as the dividend rate decreased steadily from over 4% on average in the 1970s to under 2% in the 2000s.

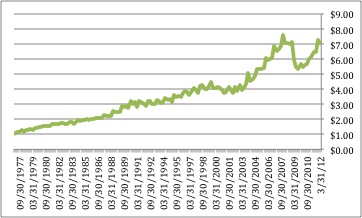

The chart below shows the payout (on a quarterly basis) of the S&P 500 since 1977, from official S&P 500 data. It generally rose until the dot-com bubble in the late 1990s and early 2000s, when fewer companies paid out dividends. And while the total dividend payout dropped from over $7 in late 2007 to $5.35 in early 2009 – about 30% – it rose again to over $7 by late 2011. Over the very long term, the trend is for dividends to increase over time.

S&P 500 dividend, 1977-2012

If the dividend were to increase to 4% and the S&P 500 remained the same, the payout would rise to $1,667 a month. Alternatively, if the invested amount were to double, the pay out would double as well, if the yield remained the same. Unfortunately, TSP’s C Fund does not pay out its dividend yield separately, so TSP participants do not have easy access to just the dividend payout.

Of course, the S&P 500 and the C Fund include companies that pay out a cash dividend and those that do not. Some increase their dividends frequently, others maintain their dividends for years, and still others drop or halt their dividends due to poor business prospects. What if you could isolate just the companies that have increased their dividends each year over very long timeframes?

In addition to the S&P 500 index, Standard and Poor’s also offers a special index made up of U.S. companies that have increased their dividends each year for the past twenty-five years. Called the “Dividend Aristocrats,” this special index currently consists of 51 companies. State Street Global Advisors currently offers an Exchange Traded Fund (ETF) that is based on the Dividend Aristocrats, and trades as “SDY” – this one includes not just the 51 companies in the S&P 500 that raise their dividends each year, but the approximately 60 companies in the S&P 1500 that do so. Its top ten holdings include such long-standing U.S. companies as AT&T, Kimberly Clark, Consolidated Edison, Abbott Labs, and Clorox. Because of its somewhat high expense ratio of 0.35%, its current dividend is 3.33%, or $16,650 per $500,000 invested. (Hence the importance of low investing fees – with a lower expense ratio, the payout for the SDY would be closer to $18,500.) This comes to $1,387.50 a month, again not quite the initial monthly payout of an annuity, but the index has increased 5.9% each year on average over the past ten years, and by definition the dividend payout should increase over time since each of the companies in the index increases its individual dividend each year. Keep in mind that this fund can drop in value as well, as in 2008 when it dropped by 23.02% according to its prospectus. This was far less than the 37% drop of the S&P 500 that year, however, and it recovered by the end of 2010.

If the fund – and the yearly dividend – were to increase 5% on average each year, the $1,387.50 paid out in the first year would grow to $2,152.47 after ten years. The dividend payout would be essential the same as an inflation-indexed annuity after five years (about $1,687 each), and after ten years the dividends would be 12% greater than the annuity. But this is not guaranteed, as the dividend payout of the SDY has remained essentially flat since late 2007, with some companies having to discontinue their payouts during 2008-9 and were therefore dropped from the index, impacting the payout. (Payouts did not fall to the extent of the S&P 500, however.)

It is important to note that in relying on dividends as in the examples above, the investor has not touched the principle amount, and that continues to grow over the years (assuming healthy economic conditions). The investor can also take a percent or two from the principle amount each year to increase his or her payout to 5% or 6%, assuming the principle amount continues to grow, or he or she can let the amount grow and pass it on to heirs or to a favorite charity. And this is where the Roth TSP and the Roth IRA come in to play, since it is easier to pass money in these accounts to heirs tax-free compared to regular TSP and IRA accounts.

Ultimately, the retiring investor now has to take into account the risk of inflation which could quickly overcome a low initial annuity payout over a 30- or 40-year period, in addition to the risk of an alternative investment going up or down over time. There are many other options, and several different strategies can be used at once. The challenge is to avoid locking in extremely low rates for the rest of your life – which itself is a risk, separate from a fund’s value decreasing suddenly – while also preserving your wealth for longevity. A fee-only financial advisor would be in a position to provide a full range of options, and he or she can additionally ensure that tax-deferred TSP funds are transferred and invested appropriately to avoid penalties or incurring higher taxes than warranted.

Related topics: annuities