Don't Overlook This Unloved Fund When Investing in the TSP

February 21, 2023

Something happened at the end of 2022 that was perhaps difficult to notice with declines across stock and bond market indices. The TSP’s I Fund, focused on developed markets/countries, began to outperform U.S.-based stock funds.

The I Fund, based on the EAFE index of developed countries, had a breakout year when it first opened in the early 2000s. Many remember the heady early days of increases, with the fund quickly outperforming the anemic growth of the C Fund. At its peak in late 2007, the I Fund was 20% higher than the S Fund and over 40% higher than the C Fund.

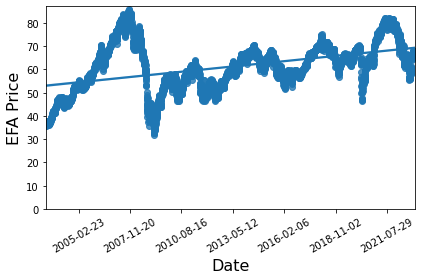

Since 2007, however, the I Fund seems to have gone sideways. Looking at the EFA, an equivalent Exchange Traded Fund (ETF) for the underlying index (the EAFE, which stand for “Europe, Australasia and the Far East”), the index appears to have gone nowhere for 15 years. After reaching a high of $86.10 in October 2007, it dropped by half to $34.68 in February 2009 like most other stock indices around the world. The ETF, like the underlying index, has never really recovered and only recently rose above $70 after hovering in the $50-$60 range for a decade.

(Note that the EFA and I Fund are both managed by the same company, Blackrock, so their price action/return should be essentially identical.)

Because of its underperformance, TSP participants have slowly decreased their allocations to the I Fund: I Fund holdings dropped below 3.1% of total TSP holdings in individual accounts last year, from 5.6% five years ago.

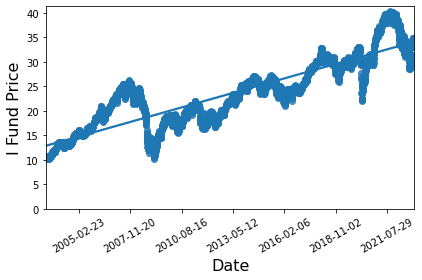

But has the I Fund really gone nowhere? No - not when factoring in dividends. You can’t really see the difference at first glance, because the TSP funds all automatically include dividends and interest in the fund price. So, investors will see a separate dividend payout when owning an ETF or mutual fund - which is usually reinvested by buying new shares - the TSP funds simply add that to the share price by automatically reinvesting into the underlying funds. TSP investors cannot choose to keep their dividends and interest payouts separate, which is one (minor) disadvantage of investing in the TSP. The I Fund has grown to over $36 a share as of January 2023 from $10 at its inception in mid-2003. That may be half the growth of the C and S Funds, but it is also double the bond-tracking G and F Funds.

Compare the price action of the EFA with the I Fund since its inception in 2003:

By reinvesting dividends over the years, the TSP’s I Fund (bottom) outperformed EFA (top), which is based on the same index.

The I Fund outperformed the C and S Funds in November and December, and the fund also outperformed the funds for the year, even if all of the funds were down for the year except for the G Fund. In November, the I Fund was the best-performing TSP stock fund since April 2020.

Without a doubt, stock fund performance in 2023 might be challenged. Inflation has yet to recede, COVID outbreaks remain a major concern in many parts of the world, and a war in Europe continues to rage.

But looking longer-term, the international fund could do much better. Here are four main reasons, based on the data and events.

First, the value of the companies in the fund are better than those in the C and S Funds. The I Fund is relatively cheaper than the C or S Funds. The price-to-earnings of the top-20 holdings in the I Fund is on average 24.1, compared to 27 for the top-20 holdings in the C Fund as of early January. The P/E of EFA is 21 for the previous 12 months, while the IVV - an ETF that tracks the same index as the C Fund - is 28 as of the end of 2022, according to Wall Street Journal market data on wsj.com.

Second, the I Fund features a better dividend payout than the C or S Funds currently. I Fund had three times the dividend payout as the C Fund as of early January, and four times the dividend payout as the S Fund. According to their respective charts on finance.yahoo.com, EFA’s yield was 4.47%, while the yield for IVV is 1.51% and for VXF (an ETF that tracks the same index as the S Fund) it is 1.12% as of early January.

Third, world events. The world is finally exiting from the last vestiges of pandemic lock-downs, with countries in Asia and elsewhere relaxing final domestic and international travel restrictions. Looking toward 2024, France is preparing to host the Summer Olympics, which will be the first truly post-pandemic Olympics since 2018. The economic benefits in the Eurozone are sure to be positive in the run up to, during, and after the Olympics take place, with a concomitant boost to international travel and tourism in 2024 and beyond.

And lastly, while the near-term state of the war in Ukraine is unknowable, once the war finally ends, the country will undergo a nationwide rebuilding effort unlike anything seen since post-World War II reconstruction in the 1940s and 1950s. While funding is a big question mark, companies throughout Europe will surely play a huge role in any major rebuilding efforts. This could also lead to a further lessening of inflationary pressures in Europe and worldwide, leading to further expansion of business investment in general. Together with reshoring and nearshoring of critical supply chains globally, the mid-2020s could be marked by massive rebuilding and investment in developed markets, with positive results for I Fund companies.

And while it is difficult to imagine now, the world will eventually move beyond final national-level bouts of COVID outbreaks after 2023. This will lead to further expansion of international tourism and trade with greater emphasis on re-shoring critical supply networks to stable democratic societies - this is another reason for a possible boom in EAFE-based countries.

There are many factors against the fund, to be sure. Aging and declining populations, high debt ratios, and prolonged global instability could weigh on I Fund – and other stock index – returns longer than anticipated. But this is true for all developed countries currently, including the United States.

The I Fund could outperform the other U.S. stock funds, or it could underperform depending on a variety of factors; past performance, as they say, are not a guarantee of future returns for any of the TSP funds. But TSP participants can consider the I Fund as one additional potential way to further diversify a growth-oriented strategy by investing even just a fraction of regular contributions in the coming years.

Plane wing photo by S O C I A L . C U T on Unsplash

London photo by alevision.co on Unsplash

Related topics: i-fund blackrock long-term-investing tsp-updates