A Funny Thing Happened on the Way to Sequestration

September 5, 2013

A funny thing has taken place since February this year.

As sequestration – and associated furloughs – became reality in the spring, the total number of TSP participants dropped by 5,000 participants through May. And the number of participants remained stagnant again through June.

At the end of December last year, there were just over 4.614 million participants. That rose to 4,619,546 TSP participants at the end of February. The number of participants then dropped to 4,614,553 in May, and remained just under 4.615 million by the end of June.

This has not happened in any meaningful way since the TSP was established in 1987.

From September 1999 to September 2000, the number of TSP participants grew by an anemic 24,000 year-over-year. The TSP also experienced low growth in the number of participants in the mid-1990s, probably due to cuts in federal employment at that time. But the TSP has experienced six-digit growth in the number of participants in most other years.

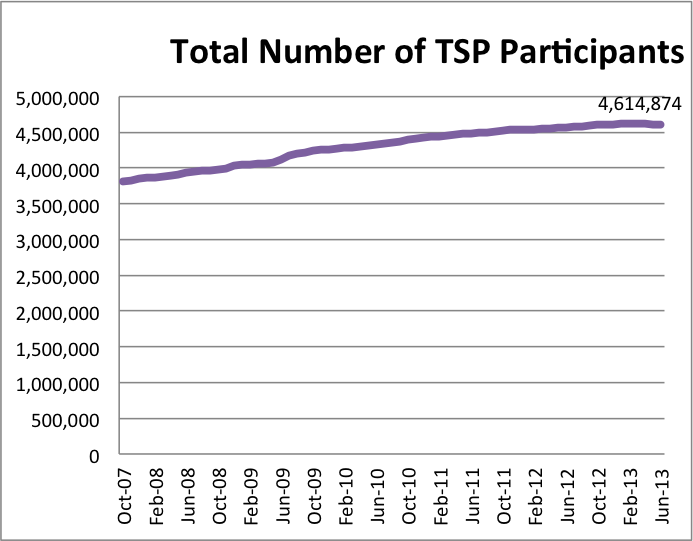

Month-over-month growth since the mid-2000s had also been robust, until now. Here is a graph of growth in TSP participants since October 2007, right before stock markets crashed in 2008-2009:

What’s notable is participation continued to grow, even as the Thrift Savings Fund as a whole declined due to sharp drops in the stock funds into 2009, and then slowly recovered from there.

Perhaps the recent stagnant participation has been due to the record number of retirements this year. That number is sure to grow in coming years, given the aging workforce and reductions in force that are just beginning to hit various departments now.

Indeed, 40% of TSP participants are over the age of 50. Because these are presumably the longest-serving participants in the TSP, they would also have the largest amounts saved in the Thrift Savings Plan, well above the average TSP account balances in the six- (and perhaps seven-) figure range. Should they retire, they could move their savings and investments to other accounts outside the TSP.

This matters because the expense ratio (fees) that pay for administering the TSP come from all participants’ accounts. The more participants in the Thrift Savings Plan – and the greater the amount held in the Thrift Savings Fund – the lower the fees all participants have to pay to maintain their accounts.

But if participation stagnates – or even declines – and if recent retirees and separated feds and military personnel pull their funds out of the TSP, then this would mean higher expense ratios (and thus higher fees) continuing participants pay to invest in the TSP, especially as TSP administrators increase budgets to pay for additional services in the future (more on that in a later post).

And outside funds are becoming cost-competitive with TSP funds, so perhaps retiring and separating feds are taking greater advantage of outside opportunities?

It’s too soon to tell if this trend will continue, but it will be interesting to watch as sequestration/sequestration-like conditions continue into the foreseeable future.

Related topics: