TSP Annuity Rate Falls to a Record Low

July 15, 2012

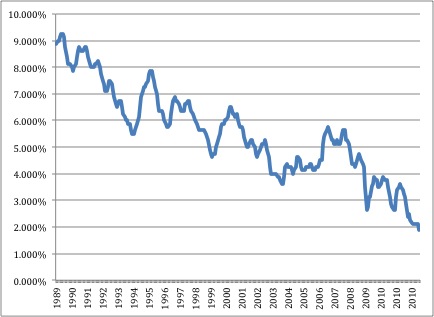

As expected, annuity rates have fallen again, to a new rock-bottom 1.875%. This continues a three-year continuous decline from almost 5% in early 2008 to under 2% this month. And given the historically low rates on U.S. treasury bonds in general (annuity rates tend to track U.S. treasury bonds), there are no signs that rates will go back up again anytime soon.

The latest low continues what has been a 20+ year trend in declines in the TSP annuity rates. While the general decrease in rates has had positive effects – mortgage rates are at historic lows too, for example – the astoundingly low annuity rates present retirees with difficult choices: Do I annuitize my TSP investments now for regular monthly income, but at a really bad interest rate, or do I hold onto my money and wait for rates to go back up? (My next article will address these questions in depth…)

The graph below shows the decreasing trend in TSP annuity rates since January 1989, taken from official TSP figures.*

Note: TSP administrators noted in April 2006 that TSP annuity rates beginning that month “reflect the provisions of the new annuity contract with Metropolitan Life Insurance Company (MetLife),” and the historical annuity rates for the period before April 2006 “reflect[ed] rates under the provisions of our previous annuity contract with MetLife and are no longer valid for comparison purposes.” While the annuity rates increased in mid-2006, the general trend remained a downward one through July 2012, as illustrated in the chart.

Related topics: annuities